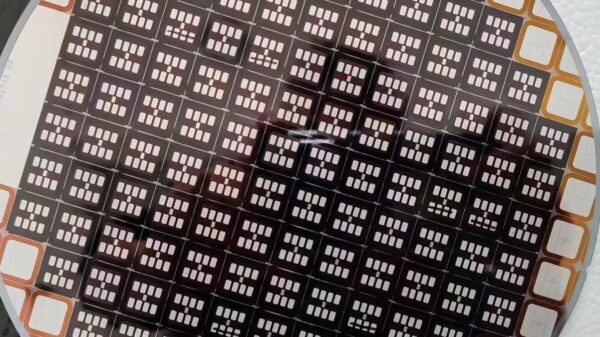

In 2022, over 30 lithium battery companies are slated to embrace large cylindrical technologies of more than 4 series, according to initial data. With a superior resilience to material expansion (over 10%), cylindrical batteries are better suited for silicon-based anodes, notorious for their expansive nature, compared to square and soft pack batteries, which typically tolerate below 8%. As a result, the 4-series-or-above large-cylindrical technology could significantly propel silicon-based anode shipments in 2023.

China's post-recombination silicon-based anode shipments are projected to hit 16,000 tons in 2022, characterised by the following: